Stats as of 20:30 GMT

Erdogan (AKP) 49.6%

Kilicdaroglu (CHP) 44.6%

Ogan (ATA Alliance) 5.3%

Ince (Homeland Party) 0.5%

Percentage of the ballot boxes opened: 93.67%

#turkey #turkeyelections #turquie #erdogan #Turkeyelection2023 #Istambul

Unveiling Truths, Inspiring Insights

Stats as of 20:30 GMT

Erdogan (AKP) 49.6%

Kilicdaroglu (CHP) 44.6%

Ogan (ATA Alliance) 5.3%

Ince (Homeland Party) 0.5%

Percentage of the ballot boxes opened: 93.67%

#turkey #turkeyelections #turquie #erdogan #Turkeyelection2023 #Istambul

1] I wish people knew this about politics and economics. Economies grow because our wants > resources. Therefore, companies try to produce things efficiently.

And, we consume them because we derive benefits.

2] If most of the things in the world were left as “free markets”, money would automatically flow to most efficient producers. In 2022, governments & citizens alike are bleeding through their nose, paying high taxes, laden with crazy debt and high inflation.

3] Why? it is a validation of the Keynesian economics going wrong. So here is the back story:- Back in the 19th century, Gold was a currency. FIAT money came and improved the speed of transaction and the fractionalisation problem associated with gold.

4] The system worked up until WW-1. Now, War is costly and if we citizens truly understood the true cost of war, no one would go to one.

5] But, this presented an amazing opportunity to devious governments to de-facto institute a system: where FIAT money (or government bonds) would be presented as a great investment opportunity to the general masses. Bonds were swapped for gold, with a promise of returns.

6] The model got tweaked and FIAT (which has infinite supply) replaced gold (which has a finite & a stable supply) at scale eventually.

7] Masses were convinced that 2% inflation is great for you (since it allows the world to grow– but de-facto it simply gives governments more power to print money).

8] The more the government can print, the more useless business it can subsidise (eg. consider Airlines, Power Plants etc in India) all are now being privatised, after ginormous failures. And, after destroying crazy amount of wealth.

9] You would ask: who gave governments so much money to destroy? Simple answer: You and me. Did we give it willingly? the answer is no. We basically gave them a licence to print as much money as they like (we pay it back through increased taxes and inflation).

10] Meanwhile, short sighted politicians go on 4-5 year spending extravaganzas dolling out political favours to people/businesses they like, offering cheap debt. Why? Because they have infinite power to print.

11] The fact remains you can earn 10 Million and put it in your bank account. You will feel safe.But, even that can be burned down to 0 through hyperinflation. Why no one talks about it? because most of the Economics that is taught in schools/universities is Keynesian

Everyone of us have heard about Crypto Currency or BITCOIN as an investment alternative or a digital currency.

But it has been seen as a threat to FIAT CURRENCY ( EXAMPLE OF FIAT CURRENCY IS US DOLLAR). As number of investors in Crypto Currencies are increasing day by day, Governments are getting more worried.

One of the power of CENTRAL BANK or Government is they can control supply of currency that is US DOLLAR. To control Inflation or to overcome deflation ( Inflation and Deflation is altogether a wider area for discussion) Government prints currency’s accordingly

However, if the world adopts BITCOIN as FIAT Currency, it will replace USD eventually. And government won’t be able to control the supply anymore. Which is a very big reason for Government to BAN crypto currencies.

As it might increase the GAP between Rich and Poor.

A detailed analysis of impact of Crypto on Inflation will be in next blog.

Here is the situation as it stands on Monday, May 22, 2023.

list of 4 itemslist 1 of 4

list 2 of 4

list 3 of 4

list 4 of 4

Annual inflation data

Venezuela: 430%

Lebanon: 264%

Argentina: 109%

Iran: 53.4%

Turkey: 43.68%

Pakistan: 36.4%

Sri Lanka: 35.3%

Ethiopia: 33.5%

Egypt: 30.6%

Hungary: 24%

Nigeria: 22.2%

Myanmar: 19.5%

Ukraine: 17.9%

Kazakhstan: 16.8%

Poland: 14.7%

Colombia: 12.82%

Sweden: 10.5%

United Kingdom: 10.1%

Chile: 9.9%

Algeria: 9.8%

Austria: 9.7%

Bangladesh: 9.2%

Italy: 8.2%

Morocco: 8.2%

Finland: 7.9%

Germany: 7.2%

Ireland: 7.2%

South Africa: 7.1%

Australia: 7%

Philippines: 6.6%

Norway: 6.4%

Mexico: 6.25%

France: 5.9%

Portugal: 5.7%

Belgium: 5.6%

Singapore: 5.5%

Denmark: 5.3%

Iraq: 5.26%

Netherlands: 5.2%

Israel: 5%

United States: 4.9%

India: 4.7%

Canada: 4.4%

Indonesia: 4.33%

Brazil: 4.18%

Spain: 4.1%

South Korea: 3.7%

Kuwait: 3.6%

Qatar: 3.6%

Japan: 3.5%

Malaysia: 3.4%

UAE: 3.2%

Greece: 3%

Vietnam: 2.8%

Saudi Arabia: 2.7%

Thailand: 2.67%

Switzerland: 2.6%

Taiwan: 2.35%

Russia: 2.3%

Hong Kong: 1.7%

China: 0.1%

G7 countries

United Kingdom: 10.1%

Italy: 8.2%

Germany: 7.2%

France: 5.9%

USA: 4.9%

Canada: 4.4%

Japan: 3.5%

BRICS

Brazil: 4.18%

Russia: 2.3%

India: 4.7%

China: 0.1%

South Africa: 7.1%

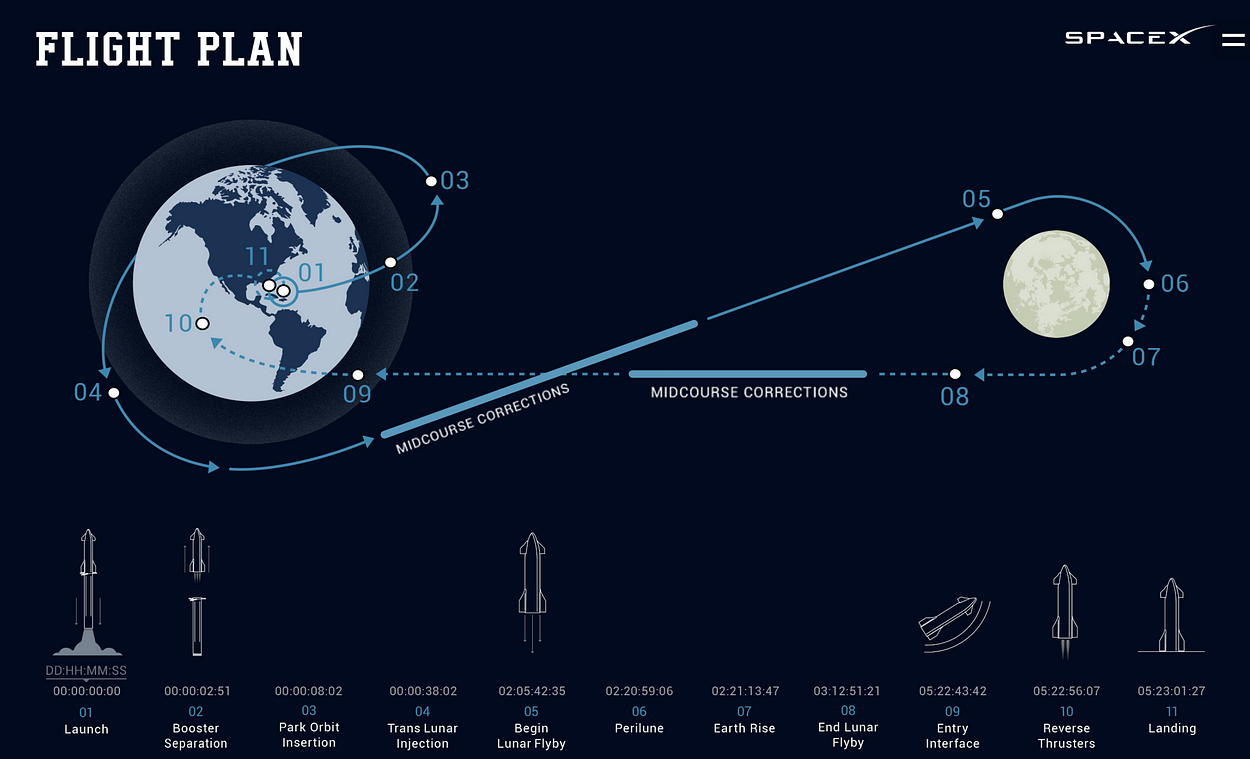

On April 16, 2021 big news was issued from NASA regarding their future plans for the Artemis Program. Previously, they had announced that by 2024 astronauts are scheduled to land on the lunar surface once again, including the first woman and first person of color.

how does the future of SpaceX tie into any of this? Well, NASA plans to use portions of their budget for Artemis to hire independent contractors that will provide additional equipment and technology. And, this past April, NASA granted SpaceX a whopping $2.9 billion in exchange for the development and use of a lunar lander to be used by the Artemis astronauts.

It’s true that since then Jeff Bezos and his aerospace company Blue Origin have filed a protest and thus NASA’s contract with SpaceX is suspended. Even so, it is likely that the contract will go through eventually and in their modern space race with Blue Origin it could undoubtedly be a big leap forward, and one that could potentially propel SpaceX to domination of the private space industry.

While the lunar lander for Artemis missions could certainly be a large project for SpaceX in the future, by no means is it their most complex or time consuming endeavor. In fact, the lunar lander is only one variant of one of their biggest projects, Starship. Below are some of SpaceX’s largest and potentially most groundbreaking developments, that are either already partially in use or in the testing phase.

Possibly one of the most well-known future projects for SpaceX is the making of Starship. With development beginning back in 2012, Starship will be an absurdly complicated spacecraft with different variants. SpaceX plans to have the first Starship ready to launch by 2023, and a fleet of them manufactured in the years after. They will all be fairly similar, but some Starships will be designed for Earth to Earth transportation, some for transporting large payloads, a few for landing on the Moon during Artemis missions, and some will serve other purposes.

With many malfunctions during test flights of prototype Starship rockets, the future was not looking bright for the spacecraft. However, on May 5, 2021 Starship prototype SN15 completed the first successful high-altitude flight test, with all systems functioning nominally and a smooth landing. It’s hard to get a good idea of the scale of it from most pictures, but Starship truly is a massive rocket, and one capable of carrying 100 astronauts into orbit, as well as potentially to Mars one day.

Starlink is an incredibly ambitious project aimed to provide high-speed and low-latency internet to locations across the globe for a fraction of the price that many older and more established telecommunication companies are offering.

The difference between normal satellite internet and what Starlink hopes to accomplish isn’t too complex at its core.

The process to connect to and use Starlink’s internet is quite simple. You just need to have a small satellite dish, similar to those used for other internet providers only not quite as large.

According to SpaceX president Gwynne Shotwell, if Starlink could acquire 25 million users then they would be profiting about $30 billion per year, much more than launching satellites earns them as of now. That money could help to fund the manufacturing of Starship and other future projects such as infrastructure on Mars.

While Starlink sounds great, especially considering its low price, there are some pretty big issues caused by the network of satellites. For starters, they can be pretty bright. Even without a telescope you can see some passing through the night sky if you live in the right area.

Unfortunately, Starlink satellites are most bright around dawn and dusk, which is the time when astronomers are performing critical observations to determine if there are any objects that could potentially collide with Earth. To address this, SpaceX has used a dark paint to coat the brightest part of the satellites, but even then they’re still fairly bright. And, with more satellites being added to the network every month the light pollution can only get worse.

Another problem caused by Starlink is space debris. Even though SpaceX has stated that Starlink satellites have the ability to maneuver to avoid other objects in space, there have already been some that are unable to do so. Highly unlikely as it is, if 42,000 Starlink satellites were orbiting the Earth and some of them experienced malfunctions resulting in immovability, the problem could rapidly get out of control.

If a few satellites were to collide that would only create more space debris that could collide with other satellites, and in a worst case scenario there could end up being so much debris circling the Earth that outer space would be deemed unsafe because of the chances of debris hitting rockets as they exit the atmosphere.

Ambitious as Starship and Starlink are, SpaceX has even greater future plans. In an ideal world, they would use revenue from Starlink to fund their large future plans detailed below.

In addition to likely designing a lunar lander for NASA’s Artemis missions, SpaceX also plans to supply a Starship for the dearMoon project. Funded by Japanese billionaire Yusaku Maezawa, the dearMoon project aims to bring Maezawa, eight civilians, and likely one or two crew members on a trip to orbit the Moon and then return to Earth.

Applications for astronauts are open to anyone, although Maezawa stated he wanted mainly artists to travel with him. If the project stays on schedule then they will launch in 2023, but recently there have been doubts expressed as to whether or not Starship will be fully ready to carry passengers by then. If the dearMoon mission goes well it would be very likely that other billionaires may be interested in doing some sort of space tourism.

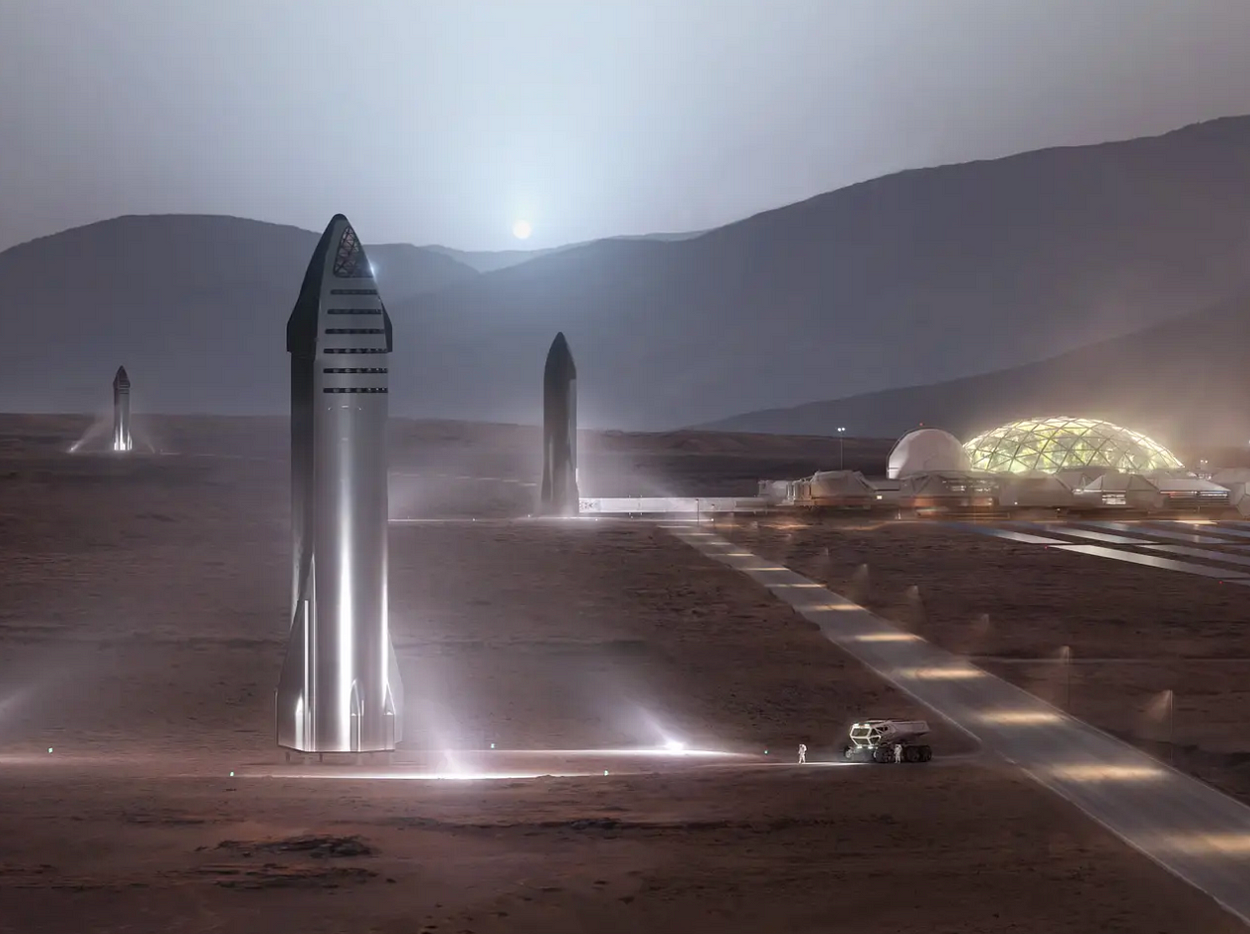

After the development of many Starship rockets, Musk and SpaceX hope to send humans to Mars by 2026, and to have a colony of one million people living there by 2050. By crunching the numbers and thinking practically you can begin to realize that it’s unlikely such a large number of people will have a home on a planet 34 million miles away at its closest in less than thirty years.

However, it is still very much possible that SpaceX is able to transport a decent amount of people to Mars, and more importantly provide the infrastructure and life support systems needed to maintain a colony on the red planet. Musk himself has said that SpaceX aims to launch three Starships per day to bring people and supplies to Mars.

If SpaceX were to launch three Starships every day that would be a true feat of both engineering and manufacturing prowess. After all, they may be reusable but if they’re traveling all the way to Mars there would need to be thousands to sustain that flow of necessary supplies.

In addition, SpaceX would have to actually build a habitat for Martian colonists, whether that’s underground to protect from radiation or a series of cylindrical and dome-like structures to ensure the inside pressure stays at a good level.

Once the colony gets more established it will hopefully grow to be more and more self-sufficient, but until then there’s still lots of work to be done

Tens of thousands of people have marched through Belgrade, blocking a key bridge in the second large protest since two mass shootings that rattled Serbia and left 17 people dead, including many children.

Protesters gathered in front of the parliament building on Friday before filing by the government’s HQ and on to a highway bridge spanning the Sava River, where evening commuters had to turn their vehicles around to avoid getting stuck. At the head of the column was a black banner reading “Serbia against violence.”

As the demonstrators passed the government buildings, many chanted slogans decrying Serbia’s populist president, Aleksandar Vučić, whom they blame for creating an atmosphere of hopelessness and division in the country that they say indirectly led to the mass shootings.

Pro-government media criticised the bridge blockade, with the Novosti daily newspaper reporting that “harassment has begun, hooligans have blocked the bridge”.

But opposition politician Srdjan Milivojevic told TV station N1: “This is a battle for survival.” He added: “If the president does not understand his people, it’s time he resigned.”

Police did not intervene.

Before the protest, Vučić, who holds nearly all the levers of power, said the protest amounted to “violence in politics” and the “harassment” of citizens. But he said police would not get involved “unless people’s lives are in danger”.

“What gives them the right to block other people’s normal lives?” said Vučić, who accused opposition leaders of “abusing the tragedy” following the shootings that deeply rattled the nation and triggered calls for change.

“They are harassing citizens and not allowing them to travel,” Vučić insisted. “But we don’t like to beat protesters, like France and Germany do.”

The rally came less than a week after an earlier protest in Belgrade that also drew thousands and other demonstrations in smaller towns and cities around the country.

At the prior Belgrade protest, demonstrators demanded the resignations of government ministers and the withdrawal of broadcast licences for two private TV stations that are close to the state and promote violence. They often host convicted war criminals and crime figures on their programmes.

The two shootings happened within two days of each other and left 17 people dead and 21 wounded. On 3 May, a 13-year-old boy used his father’s gun to open fire at his school in central Belgrade. The next day, a 20-year-old man randomly fired at people in a rural area south of the capital.

Opposition parties have accused Vučić’s populist government of fuelling intolerance and hate speech while taking hold of all institutions. Vučić has denied this. He has announced his own rally on 26 May in Belgrade, which he said will be the “biggest ever”.

“We do not organise spontaneous rallies in order to play with people’s emotions,” Vučić said. “Ours will be a rally of unity, when we will announce important political decisions.”

Vučić also told reporters that citizens had handed in more than 9,000 weapons since police announced a one-month amnesty for people to surrender unregistered guns and ammunition or face possible jail sentences after that period.

Serbia is estimated to be among the top countries in Europe for the number of guns per capita, many of them left over from the wars in the 1990s.

Other anti-gun measures after the shootings include a ban on new gun licences, stricter controls on gun owners and shooting ranges, and tougher punishments for the illegal possession of weapons.

#SSMB29: JUNGLE Adventure

• Movie Will Be Filmed in Multiple Countries

• Shoot Starts From DECEMBER 2023!

• So #MaheshBabu Will Join Before Release Of #SSMB28 in JAN 13 2024!

• He Will Undergo 3 – 4 Months Training Before Shoot.

Directed By #SSrajamouli

Also, #Rajamouli‘s dream project #Mahabharata will be a 10-part series.

Introduction: Reaching a million views on your WordPress blog may seem like an ambitious goal, but with the right strategies and a sprinkle of creativity, it’s within your reach. In this article, we will dive into proven techniques that can help you unlock the true potential of your blog and attract a massive audience. Get ready to unleash the power and skyrocket your views to the coveted million mark.

Conclusion: Reaching a million views on your WordPress blog is an ambitious goal, but with a solid strategy and unwavering dedication, it’s well within your grasp. Focus on creating compelling content, master the art of storytelling, implement advanced SEO techniques, leverage the power of social media, build an email subscriber base, and collaborate with influencers and industry experts. Remember, consistency, persistence, and a passion for delivering value are key. So unleash your creativity, connect with your audience, and watch your blog soar to new heights, attracting a million views and beyond!

#UK always leading the way with Ukraine:

– NLAWs pouring into #Ukraine when #NATO was debating

– sending anti-tank weapons

– First large scale training of Ukrainian troops

– Now Storm Shadow

-have provided maximum number of tanks till date

On 11th May 2023

#Russia Claims: –

–#Ukraine launched an attack near #Mayorsk.(15 miles south of #Bakhmut)

– Ukraine is encircling Wagner PMC in Bakhmut.

-Ukrainian armored groups near #Soledar.

– Ukrainian columns have been moving all day toward order with #Belgorod region near #Kupyansk.

Judging by the actions of Great Britain, this country decided to directly enter the war with Russia. Are the bomb shelters in London ready?

British Defense Secretary confirms that London will transfer Storm Shadow long-range cruise missiles to Ukraine…

US Attorney General Merrick Garland has approved the first transfer of confiscated Russian funds to be used for aid to Ukraine

South Africa accuses USA of giving weapons to Ukraine in a conflict with Russia. The US Ambassador has been given an ultimatum to respond why the US is escalating the war and getting involved in other countries’ matters as if they are prefects of the world.

Apple’s stock was a buy on the dip. Since the publication of my prior update, the company’s share price rose by +25.7% (source: Seeking Alpha price data), while the S&P 500 went up by +5.2% in the same time frame.

My latest write-up touches on the three key reasons for staying bullish on AAPL. The expected launch of the mixed reality or MR headset in mid-2023 could ignite investor interest in Apple’s stock and expand the long-term addressable market for AAPL. Separately, Apple’s potential introduction of an iPhone subscription plan will help to grow AAPL’s recurring revenue streams and increase the average user spend over time. Lastly, AAPL is expected to continue returning a substantial amount of excess capital to shareholders in the future, considering its free cash flow generation profile and its policy of moving towards “neutral net cash.”

The most important metrics for Apple relate to the company’s installed base.

AAPL revealed at the company’s Q1 FY 2023 (YE September 30) earnings briefing that its “installed base of active devices” increased by +100% over a seven-year period to 2 billion, which is equivalent to a CAGR of approximately +10%. In the past 12 months, Apple’s installed base expanded by 150 million devices or +8% YoY, and the installed base for AAPL in certain high-growth markets like Brazil and India even grew by more than +10% in the past one year.

It is inevitable that some investors will focus their attention on Apple’s YoY top line declines of -5.5% and -4.4% for Q4 FY 2022 and Q1 FY 2023, respectively. AAPL will witness weak product sales when its supply chain faces disruptions and demand is temporarily weakened during periods of slow economic growth. But as long as Apple continues to enlarge its installed base, it is reasonable to assume that the company’s revenue and earnings will eventually follow a similar upward trajectory over time.

At its first quarter results call, Apple stressed that the company’s growing installed base “represents a great foundation for future expansion of our ecosystem” and expands its “addressable pool of customers.” In the subsequent sections of this article, I explain how Apple’s installed base growth is closely linked to the key reasons for buying AAPL’s shares.

In my view, the three main reasons to buy Apple’s stock now are the potential introduction of a iPhone subscription plan, the planned launch of new extended reality or XR products, and sustained shareholder capital return.

An earlier February 12, 2023 Bloomberg article mentioned that Apple’s “iPhone hardware subscription program” is expected to “still arrive eventually” despite potential “delays.”

Many Apple iPhone users will typically include in their respective budgets a certain sum of money that is allocated for new model purchases. Assuming that AAPL does launch a iPhone subscription plan as reported by the media, this will allow iPhone owners to have greater capacity to spend more on Apple’s other services and products. This implies that Apple’s overall revenue can potentially grow faster, as users subscribes to more services and buy other ancillary products without having to fork up a meaningful sum of money for new iPhone upgrades every year. Also, an iPhone subscription plan will increase switching costs, and reduce the likelihood of current iPhone users switching to smartphones sold by other brands.

More significantly, I believe that Apple suffers from a valuation discount due to its dependence on non-recurring product sales. In FY 2022, AAPL derived 52% and 20% of its revenue from iPhone and services, respectively as per its 10-K filing. Other products contributed the remaining 28% of its top line in the recent fiscal year. If Apple can increase the proportion of its revenue earned from recurring sources (subscriptions and services) with an iPhone subscription offering, it will be easier for AAPL to command a higher valuation multiple.

There is a frustration lack of innovation when it comes to smartphones. It is pretty common to hear from friends that the new iPhone (or any other branded smartphone) isn’t that much different from its prior iteration. Unlike other technology segments which have seen increased investor interest in recent times due to new investment themes like chatbots, the smartphone space seems relatively “boring” in comparison. This has obviously capped the capital appreciation and valuation re-rating potential for Apple’s shares to a large extent.

An earlier February 15, 2023 Seeking Alpha News article mentioned that AAPL’s first “mixed-reality headset” might be introduced to the market in the middle of this year. Notably, Apple’s CEO Tim Cook shared in a recent interview with GQ that he thinks mixed reality products “could greatly enhance people’s communication, people’s connection,” and “empower people to achieve things they couldn’t achieve before.” It is clear that Tim Cook sees new mixed reality products as a game-changer for consumers.

It isn’t just about the excitement with new products leveraged to technologies such as mixed reality. In quantitative terms, the potential of Apple’s mixed reality headset and other related products is promising. Research firm Mordor Intelligence forecasts that the worldwide mixed reality will grow at a +41.8% CAGR for the 2022-2027 time frame. The consumer headset market is estimated to a $50 billion market by the end of this decade as per Globaldata’s projections.

As a start, AAPL has the potential to generate around $3 billion revenue from its MR headset in the initial year of launch assuming a target of 1 million and an average selling price of around $3,000. Recall that Apple currently has an installed base of 2 billion active devices, so it won’t be farfetched to see Apple’s headset sales rise substantially in the coming years through active cross-selling.

Looking ahead, Apple’s installed base should continue to expand, and the company is well-positioned to increase average spending per user with the introduction of the iPhone subscription plan and other new products & services. This suggests that AAPL’s recurring cash flow will grow over time, and I believe that this should translate into a sustained level of dividends and buybacks in the future. Apple delivered $111 billion in free cash flow for FY 2022 and the company returned $111 billion of capital to its shareholders in the most recent fiscal year, which is equivalent to a free cash flow payout ratio of 100%.

Apple had roughly $54 billion of net cash on its books as of the end of the first quarter of fiscal 2023. At its Q1 FY 2018 investor call in February 2018, AAPL disclosed for the first time that it was “targeting to become approximately net cash neutral over time.” As per S&P Capital IQ’s consensus data, analysts see AAPL’s free cash flow increasing by a +10% CAGR from $97 billion in FY 2023 to $141 billion for FY 2027. Considering Apple’s current net cash position and its expected cash flow generation for the years ahead, it is realistic to expect AAPL to continue returning substantially all of its free cash flow to shareholders.

Apple is a worthwhile investment, as I see the potential for AAPL to benefit from a positive valuation re-rating.

The market currently values AAPL at approximately 25 times forward FY 2024 normalized P/E, based on its last done stock price of $163.76 as of April 5, 2023 and its consensus forward FY 2024 EPS of $6.59.

I think that Apple could trade at a P/E ratio of 30 times or higher in time to come. A higher proportion of recurring revenue supported by product subscriptions, the venture into the mixed reality headset product category, and shareholder-friendly capital allocation policies are expected to be factors driving a P/E multiple expansion for AAPL.

The market should award a higher valuation multiple to AAPL going forward, assuming that Apple maintains a steady level of shareholder capital return, and its new offerings and subscription plans are well-received by its customers. I continue to have a bullish view of Apple’s stock.

Before COVID outbreak in 2019, mortgage rates were 3.94% and many economist thought that this is the lowest level where federal bank could go. But 2020-21 proved them wrong.

Due to global pandemic, governments all over the world had to increase their expenditure and even ordinary people needed money to satisfy their needs.

Now, if government wanted to tackle this situation, they will have to print more money and lower lending rates so people can use excess line of credit. This is basic economics. Therefore, central banks all over the world reduced their lending rates and tried to fight and then revive from this disaster.

Similarly, federal bank which is USA’s central bank reduced their lending rate to 3% in 2020 and 2.65% in 2021.

Now, when the situation starts to recover (Post Pandemic) inflation rises as more money is pumped in the economy. The most basic thing to understand inflation is if you check your monthly grocery bill before pandemic and post pandemic you will see almost 8-10% increase. This is inflation.

Now, As prices increases, there is fear of hyper-inflation so federal bank raises interest rates. Due to this, liquidity is sucked from the market. And it eventually helps to stabilize the economy.

This same policy is followed all over the world.

Now, Why does Federal Bank or Governments do these things ?

The simplest answer is ” ECONOMY’s BEST STAGE IS WHEN IT IS STABILIZE ” Stabilize means not inflationary or deflationary stage. the reason behind this is altogether a different topic for discussion.

Further, when Economy is stabilize, Federal Bank will again start reducing the Lending interest rates at very slow speed. (Not like it did at the time of COVID).